Applied Economics

Macroeconomic Modeling

Public Finance and Policy

Business Environment

International Finance

Econometrics

Financial Inclusion

Environmental Economics

The CEPAR intends to get recognition from various stakeholders for the expertise in research, consultancy and various other activities of the centre.

NISM in association with CEPAR, K.J Somaiya Institute of Management Studies and Research (SIMSR) conducted the 3rd Annual Conference on ‘Importance of Economic Research in Capital Markets’ during October 12-13, 2018. This time it was a 2-day event.

The objective of this Conference was to deliberate on current state as well as opportunities and challenges of macroeconomic research related to capital markets. Short-listed research paper presentations on contemporary issues related to economic and capital market were presented at the Conference. The first day of the conference was held at NISM Campus, Patalganga and second day at SIMSR Campus, Vidyavihar, Mumbai.

The major attraction of the first day was talk by experts, academicians, researchers, economists related to capital market.

Mr. Jitendra Kumar, Member of Faculty, NISM has given the Welcome address and also did compiling and summarizing throughout the programme. Dr. (Ms.) M. Thenmozhi, Director NISM has set the context of the conference and has given the future road map of NISM and also talked particularly about the areas of Research.

The Keynote address was delivered by Shri. Ananta Barua, WTM, SEBI. He discussed about current development in the areas of Capital Market in India and globally.

He also flagged various areas and issues for economic research and also about the strength and challenges of Indian Capital Markets.

After his address, he released a book on proceedings, in presence of another dignitaries and participants, of last year Conference on ‘Importance of Economic Research in Capital Market’ held on September 22, 2017 at NISM Campus, Patalganga.

The major attraction of the second day was a talk by Mr. Madan Sabnavis Chief Economist, CARE Rating Ltd followed by research paper presentations.

Mr. Madan Sabnavis Chief Economist, CARE Rating Ltd spoke about current macroeconomic conditions, challenges and prospects of Indian economy. He also spoke on monetary policy and inflation targeting, global factors as well as prospects and challenges of various sectors of Indian Economy.

Following selected Research papers were presented in the presence of Dr. SNV Siva Kumar, Professor & ACP, SIMSR, Prof. (Dr.) Asha Prasuna, Professor & Chairperson CEPAR, SIMSR and others.

The valedictory was done by Mr. Jitendra Kumar.

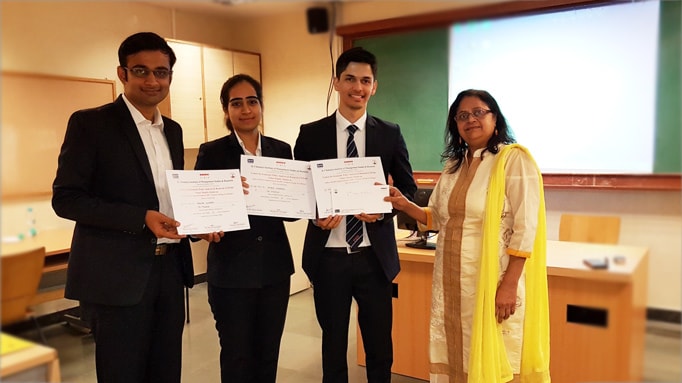

A Certificate of Participation as well as Certificate of Paper Presentation was given to the participants and paper presenters respectively at the end of the programme. The Conference proceedings will be published and be made available for future reference and use.

Mr. Jitendra Kumar, Member of Faculty, NISM and Prof. (Dr.) Asha Prasuna, Professor & Chairperson CEPAR, SIMSR were the Conference Coordinators.

| Sl. no. | Name | Title |

|---|---|---|

| 1 | Mr. Girish Joshi | Impact of Demonetization on small finance banks |

| 2 | Dr. Meghna Chhabra, Ms. Aakanksha Ralhan, Mr. Kunal Sapra, Mr.Minal Bhardwaj | NPAs in India: An Analysis |

| 3 | Mr. Rakesh Yadav | How independent (Outside) directors’ compensation structure, their frequency of meetings and concentrated ownership effects shareholder’s wealth? Evidence from Indian traded companies. |

| 4 | Ms. Shilpa Sehgal & Dr. SNV Siva Kumar | Corporate Governance Practices in Indian services sector |

| 5 | VS Parthasarathy & Dr. SNV Siva Kumar | M&A Strategies- Empirical Analysis of Indian Scenario |

| 6 | Mr. Bhaskar G & Dr. Asha Prasuna | Central Bank Intervention and its impact on currency volatility in India |

| 7 | Dr. Bhargavi J & Ms. Vaishali P | Foreign Investor flows and the Indian stock market: A causal study |

| 8 | Dr.. Shaila S & Dr. Asha Prasuna | Relationship between Stock market returns and Macroeconomic Variables in China- An Empirical Analysis |

| 9 | Dr.. Sonali S & Dr. Shaila S | Awareness and Perception about the Investment in Mutual Funds |

| 10 | Ms. Vaishali P & Dr. Bhargavi J | An investigative study on the impact of the macroeconomic fundamentals on the Indian stock market |

| 11 | Ms. Prema B | Encouraging women on board in India: Can legislation do it alone? |

One-day Panel discussion on the theme of Creating Optimal Economic Value through Right Mergers & Acquisitions conducted on October 8, 2016 at SIMSR.

Objective: Globally, Business Models are dynamically and rapidly transforming by the use of innovations driven by millennial and creating threat to traditional business.

This one day program was crafted to deliberate all vital research challenges and opportunities in M & A domain. This discussion attempted to answer much-needed research imperatives.

National Institute of Securities Markets (NISM), Finance Academy of Mahindra Leadership University (FA-MLU), Bombay Chamber of Commerce and Industry (BCCI) in association with Centre for Economic Policy analysis & Research (CEPAR), Department of Economics, K.J Somaiya Institute of Management Studies and Research (SIMSR) conducted 6th Annual International Conference on ‘Globalization at Crossroads’ during October 11-12, 2019..

The objective of this Conference was to deliberate on financial, macroeconomic, regulatory, policies that have significant influence on Globalisation during its second generation and beyond. Short-listed research papers were presented at the Conference. The first day of the Conference was held at KJ SIMSR Campus and second day at the Mahindra Towers, Worli, Mumbai.

The major attraction of the first day was keynote address by Dr. Usha Nair-Reichert, School of Economics, Georgia Institute of Technology, Atlanta, USA on Networks in International Trade.

Professor SNV Siva Kumar, Professor & ACP Department of Economics, SIMSR presented the welcome address and set the context for the Conference. Inaugural address was delivered by Shri. Vijay Srirangan, Director-General, the Bombay Chamber of Commerce & Industry (BCCI), Mumbai.

Expert talk on the topic of Modeling Credit Risk was delivered by Prof. Sandeep Juneja, Professor and Dean, School of Technology and Computer Science, Tata Institute of Fundamental Research, Mumbai.

Dr. V.R. Narasimhan, Dean, School of Corporate Governance and School of Regulatory Studies, National Institute of Securities Markets, Mumbai shared his experiences on the topic of Common Governance Dilemmas.

Following are the research paper presentations held in the second half of the Conference on Day 1, Dr. Usha Nair-Reichert and Dr. K.N.Murty, former Professor & Dean School of Economics, University of Hyderabad, were chairing the track. Prof. (Dr.) Asha Prasuna, Professor & Chairperson CEPAR, SIMSR and others were present at the session.

The Valedictory address was delivered by Mr. Govind Shankaranarayanan, Vice Chairman, ECube Investment Advisors Ltd. Vote of thanks was presented by Mr. Bivas Chakraborty, General Manager, and FA-MLU. Mr. Rajesh Kumar, Member of Faculty, NISM, Mr. Sriram Ramachandran from FA-MLU and Prof. (Dr.) Asha Prasuna, Professor & Chairperson-CEPAR, SIMSR served as the Conference.

| Talk Title | Expert | Affiliation |

|---|---|---|

| Corporate Perspective on Globalization | Mr. Sriram Ramachandran | SVP, Investor Relations Corporate Finance & Chairman FA-MLU, M&M |

| Cyber Security Awareness and Risks | Mr. NMD Shenoy | Founder & CMD, Best Fit Solutions, Mumbai |

| Towards $5Trillion Economy: Way Forward | Dr. Brinda Jagirdar | Economist and Independent Director |

Conference that is being conducted by the Centre for Economic Analysis and Policy (CEPAR), Department of Economics, KJ SIM of Somaiya Vidyavihar University jointly with the Finance Academy of Mahindra Leadership University (MLU), National Institute of Securities Markets (NISM), an educational initiative of SEBI, and the Bombay Chamber of Commerce and Industry (BCCI).

The Covid-19 pandemic has caused extreme adverse effects on various societies and economies and markets for past almost a year now. Hence, the theme of the current conference is “Coping with Post-lockdown Economic Environment”. The four tracks spread across today and tomorrow cover relevant themes namely,

Dr. Meenakshi Rishi (Seattle University), Dr. Usha Nair-Reichert, (Georgia Institute of Technology Atlanta), Dr. VR Narasimhan (NISM), Mr. Sandeep Khosla (BCCI), Mr. Sriram Ramachandran (M&M), Varghese A. Manaloor (University of Alberta, Alberta, Canada), Mr. Manish Bansal (SME Valueadvisors), Mr. V S Parthasarathy, (Mobility Services Sector), Mr. Amal Sinha (BSES Rajdhani Private Limited), Mr. Anil Talreja, (Deloitte Haskins & Sells).

| Talk Title | Expert | Affiliation |

|---|---|---|

| Teaching & Learning Challenges – International Perspective | Dr. Varghese Manaloor | University of Alberta, Canada |

| Growth Initiatives & key imperatives for India | Dr. Sachchidanand Shukla | Mahindra & Mahindra Ltd. |

| Three Farm Bills. | Dr. V R Narasimhan | National Institute of Securities Markets (NSIM), Mumbai |

| Indian Equity Markets | Mr. Viral Trivedi | LIFE Investment Advisory |

| Teaching & Learning Challenges in Higher Education – Indian Context | Mr. Sandip Ghose | National Institute of Securities Markets (NISM), Mumbai |

| Indian MSME Sector challenges during and post-Lockdown | Mr. S. Rajagopalan | Bank of Maharashtra, Mumbai |

| Key Imperatives for Success in the market Place. | Mr. Manish Bansal | SME Value advisors |

| Missing Middle in Indian MSMEs: Is capital acting as the barrier for growth of micro & small enterprises into medium sized enterprises? | Mr. Vivek Sharma | Dun & Bradstreet India Information Services |

| Green ODA, Carbon Emissions, and Institutions. | Dr. Meenakshi Rishi | Seattle University |

| Health Interventions in a Poor Region and Resilience in the Presence of a Pandemic | Dr Amitrajeet A. Batabyal | Rochester Institute of Technology |

| The future of mobility- post COVID 19 | Mr. Amal Sinha | BSES Rajdhani Power Limited |

| Technology disruptions on global business models. | Mr. Rajesh Sehgal | Equanimity Investments, Mumbai |

| Cyber risks Post Covid-19 | Mr. NMD Shenoy | Bestfit Business Solutions Pvt. Limited |

| A global perspective of Development | Dr. Usha Nair-Reichert | Georgia Institute of Technology, Atlanta |

As an annual event Centre for Economic Policy Analysis and Research (CEPAR) of Department of Economics, K J Somaiya Institute of Management in association with National Institute of Securities Markets (NISM), Finance Academy of Mahindra Leadership University (FA-MLU-M&M)

Bombay Chamber of Commerce & Industry (BCCI) and Association of Management Development Institutions in South Asia (AMDISA) is organising a two- day 8th International Conference on virtual mode with the theme ‘Economic Analysis for Contemporary Global Business’ on February 11-12, 2022.

This 8th edition of the conference theme is very apt and interesting, namely - "Economic Analysis for Contemporary Global Business". Despite the Covid-related challenges, were able to get expert international speakers from the University of Hull, Keele University, and Business School Ludong University, China.

Key Speakers:

| Name | Topic | Affiliation |

|---|---|---|

| Dr. C K G Nair | Welcome address | National Institute of Securities Markets (NISM), Mumbai |

| Mr. Bhaskar Chatterjee | Pandemic Lessons for Economic Analysis & Business Research | L&T Construction |

| Mr. S. Rajagopalan | Analysing the Potential Strengths and Weakness Of Indian MSMEs for Global Business | Bank of Maharashtra, Mumbai |

| Dr. Tirthankar Patnaik | Domestic Levers to Take Charge as Global Environment Turns Less Conducive | National Stock Exchange of India Limited |

| Mr. Ronaan Roy | Handling Social and Digital Media: Building the Corporate Brand- Rise or Good | Mahindra Group |

| Dr Keshab Bhattarai | Consumption Functions of India | University of Hull, UK |

| Dr. Christopher Tsoukis | Distributive Justice, Inequality and Growth | Keele University, UK |

| Dr. Weiguang Qin | Influence of Hong Kong RMB offshore Market on Effectiveness of Structural Monetary Policy in the Mainland China | University of Hull UK and Ludong University China |

| Dr. Sugeeta Upadhyay | Economic Outlook Survey of Bombay Chamber of Commerce & Industry | Bombay Chamber of Commerce and Industry |

In the CEPAR 2022, external faculty members from Indian Institute of Management (IIM) Tiruchirappalli, Indian Institute of Technology Roorkee (IITR), and TERI School of Advance Studies, New Delhi, Xavier Institute of Social Services (XISS), Ranchi, participated as Track Chairs at the Conference.

| Track Theme | Track Chair |

|---|---|

| Pandemic Lessons for Economic analysis and business research | Dr. SNV Siva Kumar (KJ-SIM) and Dr Varun Mahajan (IIM Tiruchirappalli) |

| Regulation vs Market-led Economy | Dr. Asha Prasuna, (KJ-SIM) and Dr Chandan Kumar (TERI School of Advance Studies, New Delhi) |

| Handling Social and Digital Media | Dr. Asha Wankhede (KJ-SIM) and Dr. Falguni Pattanaik(IIT Roorkee) |

| Economic and Income Inequalities | Dr. Shaila Srivastava (KJ SIM) and Dr. Amit K. Giri (XISS, Ranchi) |

One-day Confluence 2015: Economics of Innovation for SMEs conducted on December 19th Saturday, 2016 at SIMSR in collaboration with MIBS, Mumbai.

The Confluence was attended by about 50 plus participants who included SME representation, nominees of product/service innovation applicants, faculty members, research paper presenters and some of the MMS students from the Institute. After the program, e-proceedings was published and circulated to the participants.

Confluence 2015: Economics of Innovation for SMEs December 19th Saturday at SIMSR, Mumbai.

We work closely with clients and institutions to design and conduct collaborative research in applied economics and finance areas.

Using time series and cross section data of Indian economy, world economic outlook, UNTAD and other secondary published data Basic and time series econometric models are specified and estimated from time to time. These econometric models have been prepared for all the management domains like marketing, operations, HR and finance to get insights of data and policy inferences. Econometric models include estimation of regression equations with testing for violation in OLS assumptions like auto correlations, multicollinearity, heteroscedasticity. Panel data models, Time series models including testing for stationarity, ARCH GARCH causality, VAR, VECM.

We organize joint conferences on topics of mutual interest with the aim of having industry and academic interface. It provides platform for researchers to present their work and get inputs from the experts. It also helps in networking with industry and professionals. Conference proceedings are published for future use & reference.

Economy, industry and sector data analytics is carried out to understand data patterns and behavior.

Data Analytics - Using simple quantitative tools is done. Insights and inferences are drawn and reports are prepared and shared with the stakeholders.

The centre designs panel discussion themes and identifies experts in the respective domains to invite for a panel discussion.

The deliberations are then shared with all stakeholders for their use in decision making.

The individual faculty members undertake consultancy projects from clients to provide research based inputs on the current and prospective business challenges.

Research and analytics output will be published in various format like proceedings, working papers, white papers, concept note.

Data insights are the output of data analysis on various topics that will be made available from time to time

General and specific reports are prepared based on the client requirements and also on the new topics with varying frequencies.